2016 3rd quarter Kildare Asset Mgt-Kerr Financial Group client review letter

The 3rd quarter began as the dust from the Brexit vote was still settling and ended with widespread worries over European banks, when the Federal Reserve would raise interest rates, and the U.S. elections. In between, there were concerns over a slowing U.S. economy, debates on the impact of negative interest rates, and rumors that OPEC would cut production to try to boost the price of crude oil.

U.S. stocks began the quarter by breaking above a 2-year trading range as markets bounced from the Brexit selloff. After this move, markets traded in one of the tightest ranges in history as we went through a 26 day stretch without a 1% move for the S&P 500. September saw volatility return at the beginning of the month with a one-day 400 point Dow drop and a partial recovery into the end of the quarter.

Despite the lengthy list of worries, the major averages reached record levels during the quarter – the Dow and S&P 500 in August and the Nasdaq and Russell in September. But these new records don’t equate into a block buster 2016. It’s important to keep in mind that these all-time highs represent mid-single digit year-to-date returns.

However, these levels are over 20% higher from the February lows. As a reminder, 2016 was the worst start in history for the stock market as global equities plunged for the first six weeks of the year. It’s been a remarkable recovery especially in the face of the challenges.

While financial headlines focused on the record levels, the markets offered some subtle changes that may signal a transition of leadership. Stock indexes have recently been driven by a small group of large cap companies. This was especially evident in 2015 as the FANG stocks dominated the landscape.

A significant shift took place in the 3rd quarter. What was lagging in the first six months of the year became the leaders in the 3rd quarter. Also small was better than big as the Russell and the Nasdaq Composite (both have material small cap components) gained the most in the quarter. Size even mattered within the S&P 500 as the smallest one-third outperformed and the largest companies. (Please keep in mind the ‘smallest’ companies with the S&P 500 have market values that exceed $4 billion dollars so they are not small caps.).

Overall, notwithstanding the many cross currents, the 3rd quarter was the best so far in 2016. Here are quarterly and year-to-date performance numbers for the major averages.

3rd Qtr. 2016 2016YTD

Dow Jones Industrial Average +2.1% +5.1%

S&P 500 +3.3% +6.1% Nasdaq Composite +8.8% +6.1%

S&P 500 +3.3% +6.1% Nasdaq Composite +8.8% +6.1%

Russell 2000 +8.7% +10.2%

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends

Using a size weighted average, here is how the average Kildare Asset Management-Kerr Financial Group client’s account performed. This is calculated after all fees and expenses.

3rd Qtr. 2016 2016YTD +3.04% +11.08%

Within the specifics of your account, the closed end funds that I covered in your 2nd quarter letter continued to do well. To review, we took positions in closed end funds that focused on high yield corporate bonds, corporate loans, and taxable municipal bonds. Some of the names are Blackstone Strategic Credit Fund (BGB), Blackstone Floating Rate Fund (BSL), Blackstone Taxable Municipal Bond Trust (BBN), and the Eaton Vance Senior Income Trust (EVF). From the cost basis, the yields we are receiving range from 6% to 8%.

We purchased these when they out of favor and were significantly undervalued. Since then they have appreciated in price with some up around 15%. This is a very big move for a bond fund (you normally don’t get 2 -3 years of coupon in price increase). I am monitoring these holdings closely. Some of the issues include the current valuation after the price advance, the possibility of higher interest rates, and a possible recession.

These valuations are not extremely overvalued given market and economic conditions. As you know, bond prices move inverse to interest rates. If rates increase, it may present a headwind for these funds. Historically, however, this sector of the fixed income market is more influenced by credit risk rather than interest rate risk. In other words, the ability for the borrowers to service their interest payments to our bond funds is considered strong in an expanding economy. Higher interest rates are typically a secondary concern to the likelihood of debt service.

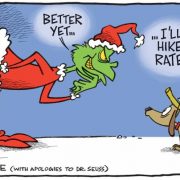

Looking forward to the 4th quarter and beyond, there are some very important sign posts ahead. The U.S. election and the probability that the Fed will increase interest rates in December are foremost.

From a glass half-full viewpoint, the 4th quarter is normally the strongest one. The 4th quarter has averaged a 2.7% gain dating back to 1928. Also since 1928, when the S&P 500 is up YTD through September 30th this quarter averages a 4.3% advance and is up 81% of the time.

2016 has been an historic year on many levels. As we work through its final three months, I will continue to navigate possible negatives from the elections and the Fed within the context of strong seasonal period. I will be looking for opportunities while trying to manage risk.

Thank you for you continued business and trust. Please contact me with any questions.